2025 proved to be another strong year for U.S. equities as resilient earnings, moderating inflation, and productivity gains supported the soft-landing narrative. While equity market leadership remained concentrated in mega-cap technology, breadth improved modestly as capital markets reopened and the cost of capital began to decline. The S&P 500 returned 17.9%, the Dow Jones Industrial Average returned 14.9%, and the NASDAQ composite returned 21.1%. The economy avoided recession, inflation converged toward the Fed’s target, and unemployment remained historically low.

Economic Outlook: Growth Continues, Composition Is Changing

As we enter February, the U.S. economy appears well-positioned to continue expanding, albeit with a different mix of drivers than in recent years. Inflation has moderated meaningfully from its post-pandemic highs, with the Core Consumer Price Index (CPI) retreating from 3.29% in January 2025 to 2.65% in December 20251. Financial conditions are less restrictive, with the Federal Reserve’s Fed Funds Target Rate decreasing from 4.25% to 4.5% in January 2025, then to 3.5% to 3.75% in December 20252. Productivity growth has improved—largely due to increased investment in technology and automation3.

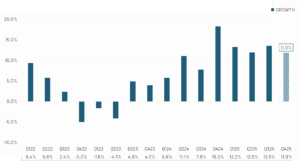

At the same time, the labor market is gradually cooling. Hiring has slowed (e.g., December 2025 non-farm payroll increase at only 50,000), wage growth is moderating, and job openings are declining. The unemployment rate ticked down slightly to 4.4% in December from November’s 4.5%, but remains elevated relatively to recent history.

Exhibit 1: Unemployment Rate (%)

Source: U.S. Bureau of Labor Statistics via FRED®, February 5, 2026

We believe that this “slow to hire, slow to fire” labor market will keep inflation pressures contained. Importantly, the current environment does not resemble a classic recessionary setup; rather, it reflects an economy transitioning from overheating to a more sustainable pace of growth.

Leading indicators suggest that real economic growth will remain healthy. The consensus estimate for real GDP growth in 2026 is ~2%4. We believe this could prove to be a low estimate given the real-time commentary from CEOs and CFOs on projected AI infrastructure spend over the next 12 months. For example, the Big Five hyperscalers (Amazon, Microsoft, Google, Meta, and Oracle) are expected to spend over $500 billion on AI infrastructure in 20265.

Interest Rates and the Fed: A New Chapter Under Kevin Warsh

Monetary policy is entering a new phase in 2026, shaped both by improving inflation dynamics and the nomination of Kevin Warsh as the next Federal Reserve Chair. While Warsh has been viewed as fiscally conservative, particularly during the Great Financial Crisis, his recent commentary suggests a strong emphasis on credibility, financial stability, and long-term growth rather than reflexive tight policy.

Under Warsh, policy may be more rules-based and less reactive, reducing the likelihood of policy mistakes that unnecessarily slow the economy. For investors, this backdrop is supportive of both equities and high-quality fixed income, particularly as yields remain historically attractive.

We expect the Fed to move closer to a neutral stance (generally viewed to be a Fed Funds rate of 2.5% – 3%) over the course of 2026, with modest rate cuts possible if inflation continues to trend toward the Fed’s 2% target. Indeed, the 30-day Fed Funds Futures imply a 65% chance that the Fed Funds Rate is reduced by 0.50% during 20266. We believe this will be a constructive backdrop for equities throughout 2026.

Geopolitical Landscape: Elevated Risk, Manageable Impact

Geopolitical risks remain elevated heading into 2026, including ongoing conflicts in Eastern Europe and the Middle East, U.S.–China tensions, and uncertainty around global trade policy. We expect this to continue during the Trump Administration. Markets have shown a growing ability to absorb geopolitical shocks without lasting damage to economic fundamentals.

Defense spending, energy security, and supply-chain resilience remain structural priorities for governments worldwide, including the United States. These dynamics continue to create both risks and opportunities across sectors, reinforcing the importance of diversification and selective positioning – we think 2026 will continue to favor active investment management.

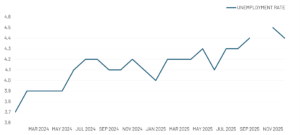

Earnings Outlook: Broader, More Sustainable Growth

Corporate earnings growth is expected to remain healthy in 2026, and leadership should continue to broaden beyond the Magnificent 7 stocks. We are in the middle of Q4 2025 earnings season, and earnings are accelerating. Going into the Q4 earnings season, the estimated year-over-year (YoY) earnings growth rate was 7.2%7. Currently, it is tracking at 12% for Q4 2025, which would make it the 5th straight quarter for double-digit earnings growth8. The consensus estimate is that earnings will grow 14% over the next 12 months9. This is a bullish sign for equity markets.

Exhibit 2: S&P 500 Earnings Growth: Q122 – Q425

Source: FactSet

Importantly, profit growth is becoming more evenly distributed across sectors and regions. Financials, industrials, defense, and select energy companies stand to benefit from higher capital spending and normalization in economic activity.

Although the valuation of the S&P 500 remains elevated at 22x forward earnings (vs. 20x over the last 5 years), we believe the elevated valuation is warranted given the strong economic and corporate growth by U.S. companies. In other words, while valuations in parts of the U.S. equity market remain elevated, earnings growth is increasingly justifying prices—particularly outside the Magnificent 7.

Artificial Intelligence: From Hype to Productivity Engine

Artificial intelligence remains one of the most powerful long-term forces shaping the economy and markets. However, the narrative is evolving. AI is increasingly viewed not just as a revenue opportunity, but as a productivity and margin expansion story. By automating tasks, reducing labor intensity, and improving efficiency, AI has the potential to meaningfully boost corporate profitability over time. Indeed, AI is already increasing labor productivity by 1.3%, and the bulk of the productivity gains will arrive within the next three to five years10. Over time, AI adoption could add 1.0–1.5 percentage points to trend real GDP growth11, consistent with prior general-purpose technology cycles. For equity markets, this supports a longer runway for earnings growth, and increases dispersion between winners and losers.

Portfolio Implications: Discipline Matters More Than Ever

Looking ahead to 2026, we believe markets are transitioning from a period where “everything worked” to one where selectivity, diversification, and discipline matter more. Equity returns are likely to be driven by fundamentals rather than valuation expansion, while fixed income once again offers a meaningful source of income and portfolio stability.

At Evans May Wealth, we remain focused on constructing portfolios designed to participate in long-term growth while managing risk thoughtfully. In an environment of moderate growth, evolving monetary policy, and rapid technological change, maintaining a balanced, diversified approach remains the most reliable path to achieving our clients’ long-term objectives.

Download a PDF version here.

1U.S. Bureau of Labor Statistics, Consumer Price Index

2Board of Governors of the Federal Reserve System, FOMC’s Target Range for the Federal Funds Rate

3Federal Reserve Bank of St. Louis, Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers

4Goldman Sachs Investment Research

5Id

630-Day Fed Funds Futures, Chicago Mercantile Exchange, as of 2/4/2026

7FactSet Earnings Insight, January 30, 2026

8Id

9Id

10Federal Reserve Bank of St. Louis

11Goldman Sachs Investment Research, McKinsey Global Institute

Sanctuary Wealth makes no representation as to the accuracy or completeness of information contained herein. Any forward-looking statements are based on assumptions, may not materialize, and are subject to change without notice. The information is based upon data available to the public and is not an offer to sell or solicitation of offers to buy any securities mentioned herein. Any investment discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Investments are subject to risk, including but not limited to market and interest rate fluctuations. Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.