The first half of 2025 was marked by volatility that tested investor patience but also reinforced the resilience of both the markets and the economy. Despite the turbulence, a combination of falling inflation, lower interest rates, and resilient corporate earnings have provided a constructive backdrop as we head into the latter half of the year.

After entering the year at record highs, equities faced sharp pullbacks tied to new U.S. tariffs. The S&P 500 briefly fell into bear market territory in April, down nearly 20% from its peak, before rebounding to fresh all-time highs by June1.

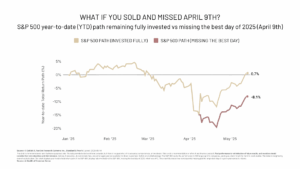

On April 9th, the S&P 500 rebounded nearly 10%, making it the best single-day return of 2025. If you sold right before and missed just this single day, your S&P 500 portfolio would be down 8.1%. A good reminder of the importance of “time in the market, not timing the market”.

Labor Market Cooling

Last week, the Bureau of Labor and Statistics (BLS) reported that July payrolls increased just 73,000 versus expectations of 104,000, with prior months revised down by 258,000, resulting in a net loss of 185,000 jobs. The unemployment rate edged up to 4.2% from 4.1% in June. Nearly all of July’s gains came from health care and social assistance, while manufacturing and government declined. Core payrolls—excluding government, education & health, and leisure & hospitality—fell for a third straight month, underscoring underlying weakness. Civilian employment, which captures small business start-ups, also dropped sharply.

On the positive side, hours worked rose 0.3% and average hourly earnings increased 0.3%, up 3.9% yearover-year. In short, the labor market is cooling at the margins, with growth increasingly concentrated in acyclical sectors, while cyclical industries remain sluggish.

The Federal Reserve and Inflation

The Federal Reserve’s challenge has been navigating a resilient labor market alongside falling inflation. The Consumer Price Index (CPI) rose 0.3% in June, matching consensus expectations, and is now up 2.7% from a year ago. The Personal Consumption Expenditure (PCE) index, the Fed’s preferred metric, rose 0.3% in June and is now up 2.6% from a year ago. “Core” PCE, which excludes food and energy, increased 0.3% in June and is now up 2.8% from a year ago.

The Fed held rates at its latest meeting on July 30th. Markets expect the Fed to maintain its “data-dependent” stance with the likelihood of one or two modest rate cuts later in 2025. Lower borrowing costs are already being felt in housing and corporate credit markets, providing some relief after two years of tightening.

While President Trump has openly pressured Fed Chair Jerome Powell to cut rates, history suggests such political influence rarely drives policy decisions to this degree. We expect a normal leadership transition when Powell’s term expires next spring. For investors, the key takeaway is that yields are trending down, providing a constructive backdrop for both equities and fixed income.

Earnings Hold Steady Despite Tariffs

Corporate earnings for Q2 are robust. As of August 1st, 66% of S&P 500 companies reported Q2 earnings, with 82% reporting a positive earnings-per-share (EPS) surprise and 79% reporting a positive revenue surprise2. While tariff concerns weighed on Q2 expectations, the blended (year-over-year) earnings growth rate for the S&P 500 is 10.3% vs. an expected 4.9% as of June 30th 2.

Looking ahead, consensus forecasts earnings growth of 14–16% in 2026, a pace supported by continued adoption of artificial intelligence and productivity gains.

GDP Rebounds—But With Important Context

Economic growth surprised to the upside in Q2, with real GDP rising at a 3.0% annualized pace versus expectations of 2.6%3. The gain was largely driven by a sharp drop in imports—boosting net exports—and steady consumer and business spending. However, much of the strength appears to be a rebound from tariff-driven distortions earlier in the year.

Many businesses front-loaded imports ahead of expected trade barriers in Q1, which suppressed growth early on and boosted Q2 figures. Core GDP—which strips out trade, inventories, and government spending—rose just 1.2%, suggesting underlying momentum remains modest. Encouragingly, inflation pressures continued to ease, with the GDP price index rising at a 2.0% rate, matching the Fed’s target.

Technology at the Helm

Technology remains the market’s primary engine. AI, robotics, blockchain, and Web 3.0 are driving productivity, corporate profitability, and capital expenditure at unprecedented levels. Semiconductor demand is projected to surge, with global AI-related data center investment expected to exceed $800 billion by 20304. For now, growth sectors continue to dominate, while value and defensive stocks have lagged.

The One Big Beautiful Bill and Ongoing Negotiations

The One Big Beautiful Bill Act was signed into law on July 4th, 2025. The bill “permanently” extended the 2017 tax cuts, locked in the current income tax brackets, and raised the standard deduction.

The US and the European Union agreed on July 27th to a broad trade deal that sets a 15% tariff on most EU goods. The EU also agreed to purchase $150 billion worth of US energy and invest $600 billion worth of investments into the United States.

Positioning

We continue to believe the key to navigating this environment is balance. We maintain exposure to highquality equities, particularly in technology and growthoriented sectors, and favor companies with strong cash flows and low debt, which are better positioned if rates stay higher for longer.

Gold has been one of the best-performing assets of 2025, supported by central bank buying, a weaker U.S. dollar (down ~10% year-to-date), and persistent concerns about fiscal deficits. In fixed income, the decline in yields makes high-quality bonds more attractive after years of underperformance.

Looking Ahead

Despite an eventful first half of 2025, we remain constructive on markets. A resilient U.S. consumer, strong earnings momentum, and powerful tailwinds from technological adoption support a bullish outlook. Risks remain—including renewed inflation, escalation in global conflicts, or a sharper slowdown in consumer spending—but we continue to view pullbacks as opportunities, not obstacles.

While markets are often volatile in the fall, 2025 has been anything but typical—and this year’s unique mix of policy shifts, tariffs, and geopolitical surprises makes historical patterns less reliable as a guide. For long-term investors, the path forward may be bumpy, but the destination continues to look promising. We continue to believe we can end the year higher.