The first half of 2022 is now (thankfully) in our rear-view mirror and the first week of July has started off stronger. There are some glimmers of hope in recent economic data. Corporate earnings have held up relatively well. The labor market remains robust, and the consumer is still in a strong position. We are cautiously optimistic about the remainder of 2022 but expect volatility to continue.

The S&P 500 suffered its worst first half since 1970 closing out June at -19.96%. The Dow Jones Industrial Average was -14.44%, the worst performance since 1962. The NASDAQ Composite was -29.51%, its worst performance on record.

Bonds were not spared with a dismal -10.35% performance through June, the worst performance on record based on data going back to 1975. In summary, there were very few places to hide in the first half of 2022.

The poor performance for the first half of 2022 is not necessarily an indication of what lays ahead. According to analysis by S&P Dow Jones Indices, there has been little to no historical correlation between the S&P 500’s performance in the first and second half of the year.

As we look forward, the risks that plagued the market during the first half of 2022 still exist — surging inflation, interest rate hikes, and the potential for a recession. However, the market now better understands these risks, and we are starting to see glimmers of hope that make us cautiously optimistic for the second half of 2022.

We discuss each of these risks and how they impact our outlook for the rest of 2022.

Inflation

Inflation has certainly proven to not be transitory. Instead, it has been surging and persistent, and now seems to have invaded every sector and channel of the economy. Excess money supply, supply chain challenges, a very tight labor market, and the Russia/Ukraine war are to blame.

The Consumer Price Index (CPI), which measures the average change over time in prices of goods and services, showed an 8.6% annual increase in May, up from an 8.3% annual increase in April and an 8.5% annual increase in March. As a point of reference, over the last 20 years, the only time the annual increase in CPI was above 5% prior to the most recent surge in inflation was the summer of 2008.

Food, energy, and shelter price categories make up over 50% of CPI, so the trend of these items is very important to the trajectory of CPI. We are starting to see some cooling off in food and shelter prices. Crude oil has come down by approximately $20 per barrel[1] since $120 per barrel highs in June, primarily based on demand concerns given a higher probability of a recession. This could translate into lower gasoline prices, although it remains to be seen whether price levels will remain at or below these levels for the remainder of 2022. Natural gas has come down by over 37%[2] since its recent high last month. Food commodity prices have also come down markedly over the last month. Month-over-month price increases or decreases in energy, food, and shelter will be vitally important to understanding whether inflation is starting to cool.

Inflation will not cool overnight or even over a quarter. Inflation peaks tend to be a process. History shows that energy and goods prices almost always peak before services prices (services make up over 50% of CPI and include the shelter component). As previously mentioned, energy prices are trending downward. Major retailers, manufacturers, and semiconductor producers have discussed excess inventory, which may help reduce goods prices over time.

To be clear, it is still early in the inflation peak process but some of the trends are reassuring and give us hope that we may be at the peak of inflation.

Interest Rates

The outlook on interest rates is inextricably linked to the outlook on inflation. For the first half of 2022, the Federal Reserve (via the Federal Open Market Committee, or FOMC) was delayed in recognizing and fighting inflation. It was not until March when the FOMC approved a 0.25% hike to the target Federal Funds rate, the first interest rate hike since 2018.

The Federal Funds rate is the interest rate that banks charge each other to borrow or lend on excess reserves overnight, which in turns impacts interest rates paid on virtually every other type of lending facility in the market (e.g., credit cards, mortgages, business loans, etc.). The Fed Funds rate also impacts key bond market interest rates, like U.S. Treasury yields. Changes to the Federal Funds rate has a significant and pervasive effect on the economy.

The goal of increasing the Federal Funds rate is to slow down economic activity which should, in theory, reduce excess money supply, slow down price growth, and, ultimately, bring inflation closer to the Federal Reserve’s target inflation rate of 2% per year. The challenge the Federal Reserve faces in raising rates is that it could potentially send the economy into a recession.

Since its first interest rate hike in March, the FOMC has increased the target Federal Funds rate to 1.50% – 1.75%, and expectations are that the FOMC will increase the target rate by another 0.75% at their July meeting[3]. Currently, the market is pricing in the Federal Funds rate peaking at 3.25% by the end of the year, before rates being gradually cut in 2023[4].

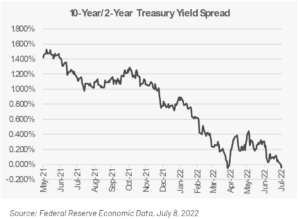

For the first time in six months, it appears the market and the Federal Reserve are finally in sync. The market has priced in a significant increase to the Federal Funds rate, and we expect the bond and equity markets to continue to be volatile if there are surprises in inflation data, economic data, or behavior by the FOMC. One key metric that we focus on is the 10-year Treasury yield. The equity markets are responding favorably to a 10-year Treasury yield at or below 3%. We believe that the equity markets may be able to find footing if the 10-year Treasury yield remains at or below current levels.

Recession Fears

There is an old saying: “It’s not a matter of if there will be a recession, it’s a matter of when and how long.” Recessions are inevitable and a normal part of the economic cycle and investing.

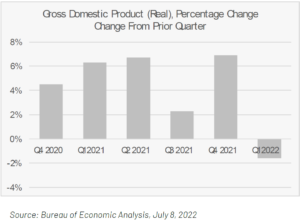

The National Bureau of Economic Research (NBER) is the official arbiter of recessions. Despite what many believe, a recession is not strictly defined as two consecutive quarters of negative Gross Domestic Product (GDP) growth. Instead, the NBER defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” NBER looks not only at negative GDP growth, but also rising levels of unemployment, falling retail sales, and contracting measures of income and manufacturing over an extended period.

Real GDP growth decreased 1.6% during the first quarter of 2022. Unsurprisingly, this has prompted some market commentators to opine that we are already in a recession.

Fear of a recession has also started to make its way into the bond market over the past month, sending the 10-year Treasury yield below 3% this week and temporarily causing an inversion of the yield curve (i.e., when the 2-year Treasury yield rises above the 10-year Treasury yield).

On the other hand, nonfarm payrolls rose by 372,000 jobs (vs. estimate of 265,000) and unemployment rate remained unchanged at 3.6%, based on economic data released on July 8. The data reinforces that the labor market continues to be robust.

We believe this most recent economic data gives the Federal Reserve the “green light” for an aggressive rate hike at the July FOMC meeting. While this may seem counterintuitive, the more decisive and aggressive stance on inflation by the Federal Reserve has been welcomed by the bond and equity markets and should help alleviate investor fears of runaway inflation, at least over the short-term.

Conclusion

The next challenge for the market is the upcoming Q2 earnings season. The big banks (JP Morgan, Citigroup, etc.) kickoff earnings on July 14 and will give us a glimpse at the strength of the consumer and household balance sheets. From there, we will hear from companies on whether they are passing along additional input costs to the consumer or, instead, absorbing higher costs thus resulting in lower margins.

Q2 earnings season wraps up in late August. Along the way we will receive two additional CPI prints, witness one additional FOMC meeting, and receive a myriad of other economic data.

Looking forward, we are acutely focused on earnings. We believe earnings results and new economic data will likely set the scene for the remainder of 2022.

If you have any questions or would like to discuss your portfolio, please contact our office.

– Evans May Wealth

Read the written commentary here.

[1] Based on WTI Crude September 2022 futures prices, as of July 7, 2022

[2] Based on Natural Gas August 2022 futures prices as of July 7, 2022

[3] CME FedWatch Tool, as of July 8, 2022

[4] Federal Reserve Bank of Atlanta, as of July 7, 2022