With the latest tariff announcement from President Trump on Wednesday and the subsequent market volatility, we wanted to send a quick update to analyze the situation and reassure you on our strategy and outlook ahead.

In summary, a 10% baseline tariff policy will be imposed on April 5th on all countries, excluding Canada and Mexico. We view this as a longer-term structural rebalancing of trade policy. Additional tariffs will be imposed on April 9th for the 60 “worst offenders”. These vary by country based on the existing trade deficit and imported goods. We see these more punitive tariffs as a broader negotiation strategy that could be shorter term. This is a very fluid situation, and China has since announced retaliatory tariffs of 34% on US imported goods.

We think of the tariffs as a “three S” change in how things work—structural, secular, and systemic. Structural in nature, including the rewiring of the international trading system, secular in duration, with meaningful second and third round effects, and systemic in impact, with significant reach.

Tariffs that were already in place have raised $100bn, and the latest tariffs are anticipated to raise an additional $620bn. The new tariff policy sets an average tariff rate of 18.3% on imports—bit higher than expected, but roughly 1/3 of total imports are exempt, softening the overall impact to a 12.6% increase in the effective tariff rate. Combined with other tariffs this year, we estimate the total U.S. effective tariff rate could jump by 18.8%.

Ultimately, this leads to uncertainty in business planning for companies with global customers and supply chains. The uncertainty has spurred additional volatility in the stock and bond markets, and we expect this volatility to continue as negotiations unfold and as we head into earnings season.

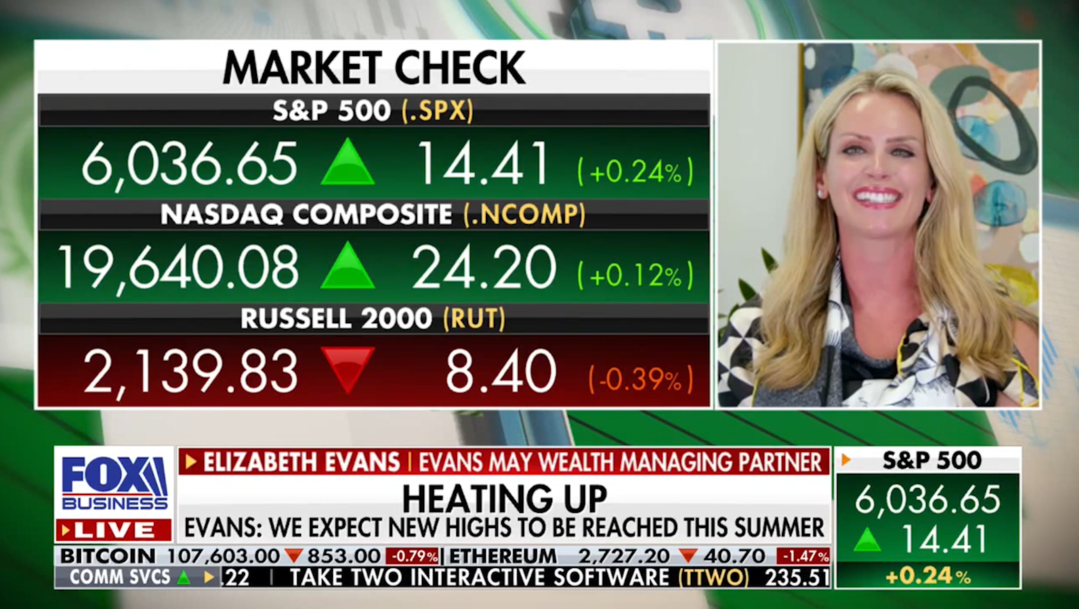

But, as we have more clarity on tariffs, the economy, and interest rates, we should see stabilization. We expect the increased tariff revenue to lead to extended tax cuts, plus the possibility of additional tax cuts. The market doesn’t appear to be pricing this in. The futures for the Fed Funds Rate are pricing in five rate cuts this year, but we think that is optimistic. The Fed has always been backward-looking in its decision-making process, and we believe it will take time for the impact of tariffs to be reflected in the economy. Earlier today, Fed Chair Powell confirmed this conclusion.

And let’s not forget we are still up 76% from the October 2022 lows. A pullback of 15-20% would be considered normal, and we still believe this to be an investable market. We’re monitoring the situation closely and adjusting portfolios as necessary. This type of market environment is why we favor diversification, rebalancing, and owning high-quality companies and investments. While not entirely immune to volatility, higher-quality companies tend to hold up better in periods of turbulence.

And remember, some of the best individual days in the market come the day after some of the worst individual days – a good reminder of the value of patience and avoiding market timing. Thank you, as always, for placing your trust in our team. If you have any questions, please do not hesitate to reach out.