Corporate resilience is the real story this earnings season 💡

Investors have seen one surprise after another this year. Despite the tariff turmoil and Fed uncertainty, companies are beating expectations and now increasing their forward guidance.

What is remarkable to us is:

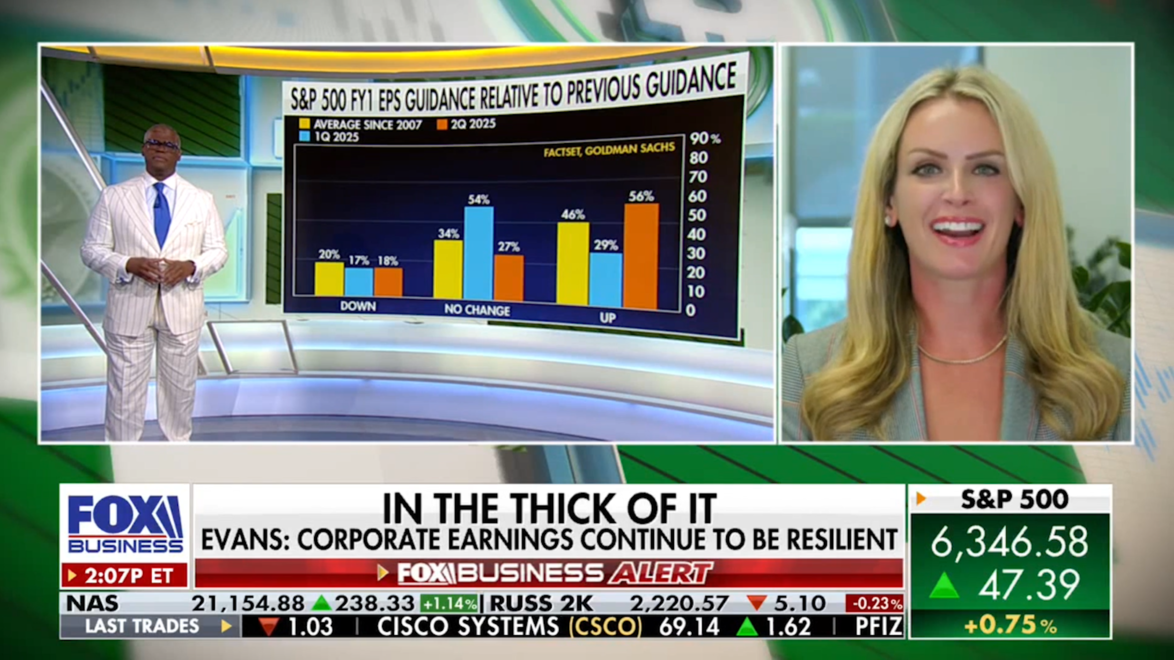

📈 Earnings growth is tracking at 10.3% year-over-year, more than double the 4% estimate

📈 Guidance is up at 56% compared to 29% in Q1

Watch my Fox interview with Charles Payne to hear more insights on why Lizzie’s remained optimistic 👇

Transcript:

Hey folks, my next guest did not waver from her bullish stance even when the street was beating that hasty retreat and telling you to get out of this market. She remained optimistic, in part because of technology. So, I want to bring in Evans May Wealth managing partner Elizabeth Evans. And, you know, Elizabeth, although they have taken a lot of these names out to the woodshed this earnings season, you say the real story of this earnings season is corporate resiliency.

Good afternoon, Charles. It’s amazing. Two thirds of the companies in the S&P 500 have reported. And of those reporting, 63% have beaten expectations. So that’s meaningful. It’s one of the highest numbers we’ve seen in the last 25 years. I’ve seen some naysayers say that the bar was set too low going into this earnings season, and it’s fair. Earnings growth was expected to be 4% year-over-year.

And right now, we’re tracking at 10.3% earnings growth. That’s huge, especially given all the pessimism around tariffs and trade policy. And also you know I know you use this chart in your report to your points and the guidance, right, it’s not just that they beat this low bar but this guidance, right? Up guidance 56% to 29% in the first quarter and on average since 2007, 46%. Just absolutely blown them away.

And I guess that’s why those who come up just a little bit short pay a heavy price. I want to speak more about earnings. But technology, communication services, obviously these are areas that you like. These areas that you said would carry the market. Communication services coming into the quarter. Wall Street thought they’d be up 29%. They’re up almost 41%. Tech instead of 16%, they’re up over 21%. But, there are a lot of these names are pulling back. I guess the question here is, even with these huge beats, could you argue that the sector has been priced for at least near-term perfection? Well, that’s a great question and I sound like a broken record, but we continue to believe tech will be the leader.

Financials should also perform very well. And what I think is so interesting, Charles, is if we look at earnings so far, you mentioned all the sectors that have outperformed. If we look at the Magnificent Seven and let’s pull out Nvidia because we know Nvidia doesn’t report until August 27th. Year-over-year earnings growth of those six companies is +26%.

The rest of the S&P 500 is +4%. So that divergence continues. And we think that that trend will be here to stay. Let’s talk about some specific companies. Got about a minute and a half I got to go Uber I know you have a buy in Uber. They reported this morning. It’s kind of been up and down.

You know they always give the CEO a pretty good interview. When I’m looking at those, a stock that’s pulled back. It’s under its 50-day moving average I don’t know if it’s near-term. It’s a little bit of a yellow flag. But you like this long term. Why? Well Uber had an incredible report. They were right spot on on earnings versus expectations.

But, they beat on revenue plus 18%. What I loved from the CEO this morning was not only did he tell us that the consumer is resilient both here in the U.S. and abroad, but they have in the last year generated $8.5 billion in free cash flow. They’re returning that to their shareholders. They just announced a $20 billion share buyback.

That’s meaningful. Meta’s a name you like here, Elizabeth. Would someone not in the stock, though, chase it from where it is now? We’re going to get a chart here in a second. Yes. We think for investors who don’t own Meta or underweight Meta, there’s still a tremendous amount of upside here. So we liked Meta going into earnings.

But they just absolutely crushed it both on revenue and EPS beat. What I think is super interesting about Meta is that their operating margin’s at 43%. So that’s a 500 basis point growth in the last year, which just underscores the leverage that they have. Got less than 30s. But I got to ask you about this, Palo Alto Networks. It’s gotten slammed here.

Listen, I watched this stock for a decade and it does this from time to time. You know, it misses and it gets annihilated. I guess you’d like it here. You’re doing some bottom fishing. Would the caution be that from time to time, it might get hit? Yeah, I think what’s happened here recently is that it’s been really it’s pulled back since its announcement to acquire Cyber Ark, which is a $25 billion acquisition.

So the market didn’t like the price tag. Did they overpay? Perhaps. But we think it’ll be accretive to cash flow in 2028. This is a great opportunity for a long-term investor. Goldman has a price target of $231 a share. It’s about 35% upside from here. Elizabeth, thank you. Appreciate it. Talk to you again. All right.