Written by James Royal | Edited by Brian Beers

Dividend investing is popular with many kinds of investors, but especially with older investors, many of whom are looking for a reliable stream of income to fund their golden years. The best dividend stocks can pay a meaty dividend and grow it over time, too. And with inflation dogging investors, now may be a particularly good time for dividend stocks.

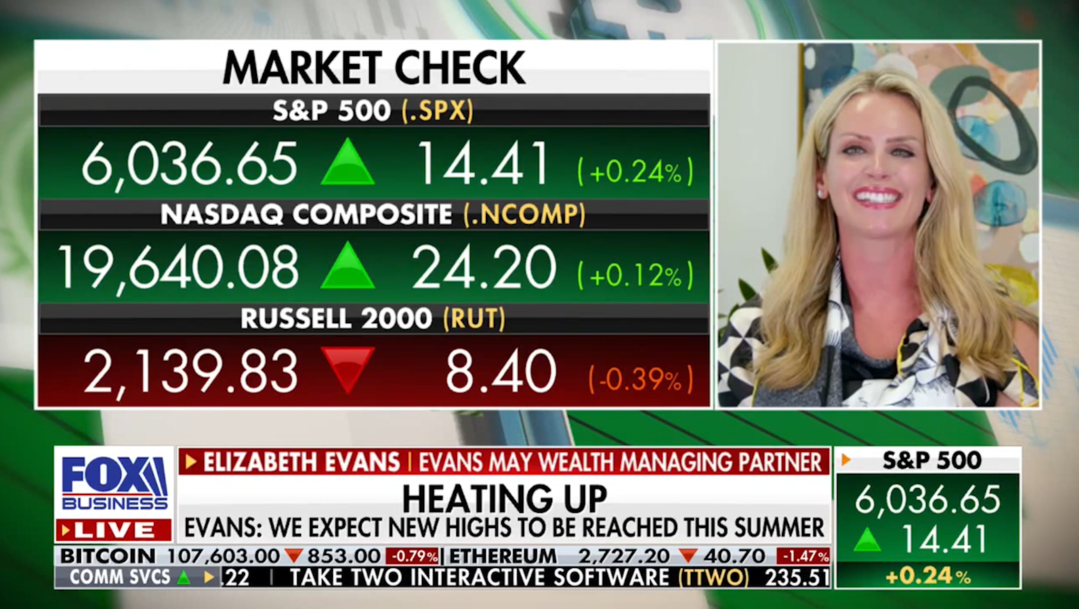

“Dividend-paying stocks tend to be more defensive and outperform growth stocks in periods of high inflation, high interest rates, and economic uncertainty,” says Elizabeth E. Evans, CFP, managing partner with Evans May Wealth, a wealth management firm in the Indianapolis area.

But how can you best take advantage of dividend stocks? Top investors use many tricks to get the most out of them – here are some of the secrets to successfully investing in dividend stocks.

Top tips for investing in dividend stocks

The five tips below are both things to do and things to avoid doing. In investing, it’s often just as important to avoid doing unwise things as it is to actively do smart things.

1. Find sustainable dividends

Finding a sustainable dividend is one of the surest ways to avoid loss, which is the No. 1 (and No. 2) rule of legendary investor Warren Buffett. When it comes to dividend investing, one of the best ways to avoid loss is to look for a company that can sustain its payout even if business declines in the short term.

Why is a sustainable dividend so vital to an investment? If investors think that a company has an unsustainable dividend, they’ll push down the stock price in anticipation of a dividend cut. Then if and when a dividend cut actually happens, the stock will almost assuredly get pummeled again, as investors flee. Many large investors such as investment funds will reduce their positions or may be forced to sell entirely if the company cuts its dividend completely.

One quick check on whether a dividend may be sustainable is to see what percent of the company’s profit goes to pay the dividend. Companies that pay less than 50 percent of their profit out as dividends are more likely to weather a downturn in the business without cutting. Still, some companies such as REITs can safely pay out more cash flow without much trouble.

Investors can also check out stocks that are included in lists such as Dividend Aristocrats, to see which companies have long-term track records of maintaining and growing their payouts.

2. Reinvest those dividends

Getting a cash payout from your stock is valuable, but if you spend that cash, you won’t be able to take advantage of the compounding effect of reinvesting your dividends. Reinvesting your dividends can give your portfolio a needed boost and supercharge your investment gains.

“Since the 1930s, more than 40 percent of the returns of the S&P 500 can be attributed to dividend income,” says Evans, who says that dividends play a particularly important role when the market’s returns are low. “Dividend income tends to cushion the price volatility of stocks and, therefore, mitigate overall volatility in a portfolio.”

Many brokerages will reinvest your dividends automatically if you instruct them to do so, and they’ll even buy fractional shares, so you can put all that money to work immediately. Then when the next dividend is paid, you’ll make even more money on your payout. At its best, you’ll create a virtuous circle, in which your wealth continues to compound with each quarterly payout.

It’s worth noting that dividends are taxable, even if you reinvest them. So dividend reinvestment may work best inside tax-advantaged accounts such as an IRA or a 401(k). Inside these accounts, you won’t owe taxes immediately (or maybe ever, if you use the Roth versions.)

3. Avoid the highest yields

When you’re looking at lists of the market’s top-yielding dividend stocks, it can be tempting to pick the ones with the highest dividends. After all, that would seem to be the quickest way to compound your money. But often those high yields are dangerous. They’re a sign that the market does not trust a dividend’s sustainability, and so the market pushes the stock price down to compensate.

Buying the highest yields “can be detrimental, as many times these high yields are transitory and may be made up of one-time distributions that increase the yield temporarily,” says Brian Robinson, CFP, financial advisor and partner with SharpePoint, a wealth management company in Phoenix. “These types of securities tend to be extremely high in price volatility as well.”

So unless you’re an expert at analyzing investments, it’s best to avoid the market’s highest-yielding stocks. If you buy the highest yields, you could quickly lose much more money than you’d ever earn with that tempting but illusory 8 or 9 percent yield.

4. Look for dividend growth

“Dividend growth is far more important than dividend yield,” says Evans.

Many investors get caught up in looking at a stock’s current high yields and fail to consider how much a company can grow its payout over time. But a growing payout will help you mitigate the effects of rising costs on your portfolio, and that’s crucial if you’re investing for decades.

“Don’t forget inflation,” says Robinson, who advises that a good dividend portfolio “should keep up with the average annual increase in the cost of goods.”

Investors can run a few checks on their company to see what its dividend growth might look like in the coming years:

- Dividend payout ratio: This is the ratio of dividends to total profits. The lower the figure, the more the company could raise its dividend safely.

- Dividend growth rate: This is how quickly the company has raised its dividend in the past. Higher growth may signal that a management is willing to pay shareholders more.

- Earnings growth rate: A company that continues to grow its earnings will have more capacity to grow its dividend, too. For example, a company that grows its earnings at 10 percent annually could potentially also grow a dividend sustainably at that rate.

“If a company can generate strong and sustainable free cash flow from operations, then there is a greater likelihood that the company will be able to grow its dividend and continue to deliver strong returns to shareholders over time,” says Evans.

5. Buy and hold for the long term

If you’re really looking to turn your portfolio into a dividend dynamo, then you’re going to need to invest for the long term. That means finding a solid dividend-payer and then sticking with it over time. That time element is absolutely crucial, but it’s easy to get tripped up when bad news hits.

Look at the experience of Warren Buffett and his purchase of Coca-Cola stock at his holding company Berkshire Hathaway. Berkshire purchased 400 million shares of the drink company for about $1.3 billion nearly three decades ago. The stock has risen, of course, and is worth about $25 billion, as of June 2022. But check out what Berkshire earns in dividends.

Coca-Cola pays about a 3 percent dividend yield today – not especially high – but Berkshire’s yield on its investment is enormous. Coke is due to pay out about $700 million this year to Berkshire. So, the company is earning more than half its original investment each year on dividends alone.

And that’s the power of dividend investing with a buy-and-hold mentality.

Bottom line

All too often many people think of dividend investing as the province of stodgy investors, but dividend investing can be one of the most stable and lucrative forms of investing. Use these five secrets above to improve your dividend investing strategy, and remember to always think long term.