Mega-cap earnings, Fed decision, and the jobs report, all in one week! What should investors pay attention to?

After a rocky first half of the year, the market is priced to perfection now. And just last week, the S&P 500 was up all five days, which we haven’t seen since November 2021. 📊

Moments like this are a good reminder that investing is rooted in fundamentals, not emotions.

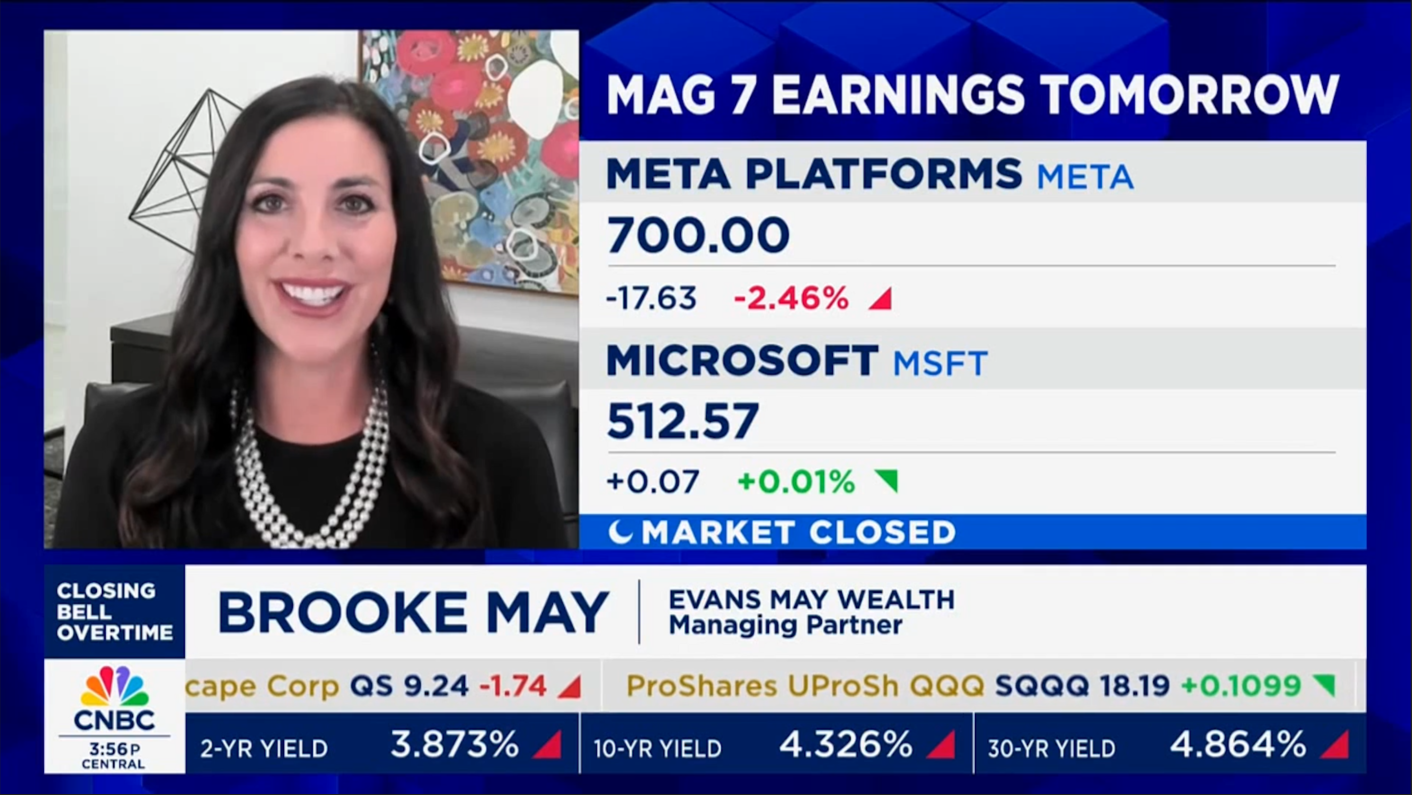

I shared more on how to navigate this environment in my latest CNBC interview below!

Watch the full video below or on CNBC’s website here!

Transcript:

And one more thing to watch tomorrow is the latest fed decision. Joining us now to look ahead to the fed and earnings is Brooke May from Evans. May Wealth. Brooke, stocks aren’t moving right now in overtime even on relatively positive earnings. Visa, which I know you own, is a key example. But we’ve got some mega caps reporting this week.

We got the fed. We got a jobs report. What’s going to matter most?

All of it. You know there’s definitely a combination of data this week. And you’ve got to keep an eye on everything. You know, right now when we look at earnings, companies are expected to not just beat on earnings and on revenue, but give stellar guidance.

Otherwise they’re likely to be punished. The market right now is priced to perfection.

So, does that mean that investors should have a bias toward things going down from here? How do you invest in that environment?

No. Not necessarily. You know, right now it’s you really have to look at individual companies and what their impacts are in this environment.

You know, when we look last week at the market, all five days, the S&P 500 was up. That hasn’t happened since November of 2021. And when you look at Polymarket, which is a platform that takes bets on everything, it’s only pricing in about a 17% probability of recession. So, right now, we think that their complacency is the biggest issue.

If you’re contrarian, too much complacency leaves some concern. I mean, we just heard from the CEO of Nucor earlier this hour as well, who also seemed to think that the economic outlook here in the US is perhaps stronger than folks have anticipated, or at least, earlier in the year, were expecting. So interesting to hear about the Polymarket results.

I do want to stick with these four Mega-Cap tech companies combined $11.3 trillion in market cap.

The Mega-Cap tech companies represent a fifth of the S&P 500, just how much hinges on these results versus everything else?

Well, they’re definitely going to move the S&P 500 because they are such a big player in that space. And so we’re watching them closely.

And again they have to give stellar guidance. Just beating on earnings and revenue expectations isn’t going to do it. And these companies they’ve embraced AI. You know, we think that right now big tech is leadership. And we think that while they’re a little overbought right now, they’re going to lead the way. We’re in a megatrend for growth companies right now. And we don’t see that subsiding anytime soon.

What is going to matter from the fed decision and the Powell presser tomorrow?

Is it going to be the idea that maybe September is in play?

There’ s a lot of focus on the double descent, but markets are already looking to September to see whether we get a cut. Yeah, there is a decent probability that we’ll see a cut in September and that’s what’s being priced in.

I don’t necessarily agree though. You know, right now when we look back the last few years over and over again, we’ve seen quite a few rate cuts being priced into the market and they don’t materialize. So, you know, just a few months ago, there was a 95% probability that we would see three rate cuts. And now I don’t know if we’ll see 1 or 2 this year.

It’s an interesting time where there’s pressure on the fed. But their dual mandate is maximum employment and price stability. And we’ve got both of those right now. So there really isn’t the urgency to act. All right, Brooke, May I appreciate it.