Written by Amruta Khandekar and Devik Jain | Edited by Shounak Dasgupta

U.S. stock indexes fell on Wednesday as a rally in growth shares faded and Target slumped after the retailer became the latest victim of surging prices.

Shares of Target Corp fell 25.1% to the bottom of the S&P 500 after its first-quarter profit halved and the company warned of a bigger margin hit on rising fuel and freight costs.

Shares of other retailers such as Walmart Inc, Gap Inc, Kohl’s Corp, Nordstrom Inc, Costco , Best Buy, Macy’s Inc and Dollar General Corp dropped between 4.1% and 11.8%.

All of the 11 major S&P sectors declined in morning trade, with consumer staples and consumer discretionary sectors down 3.5% each.

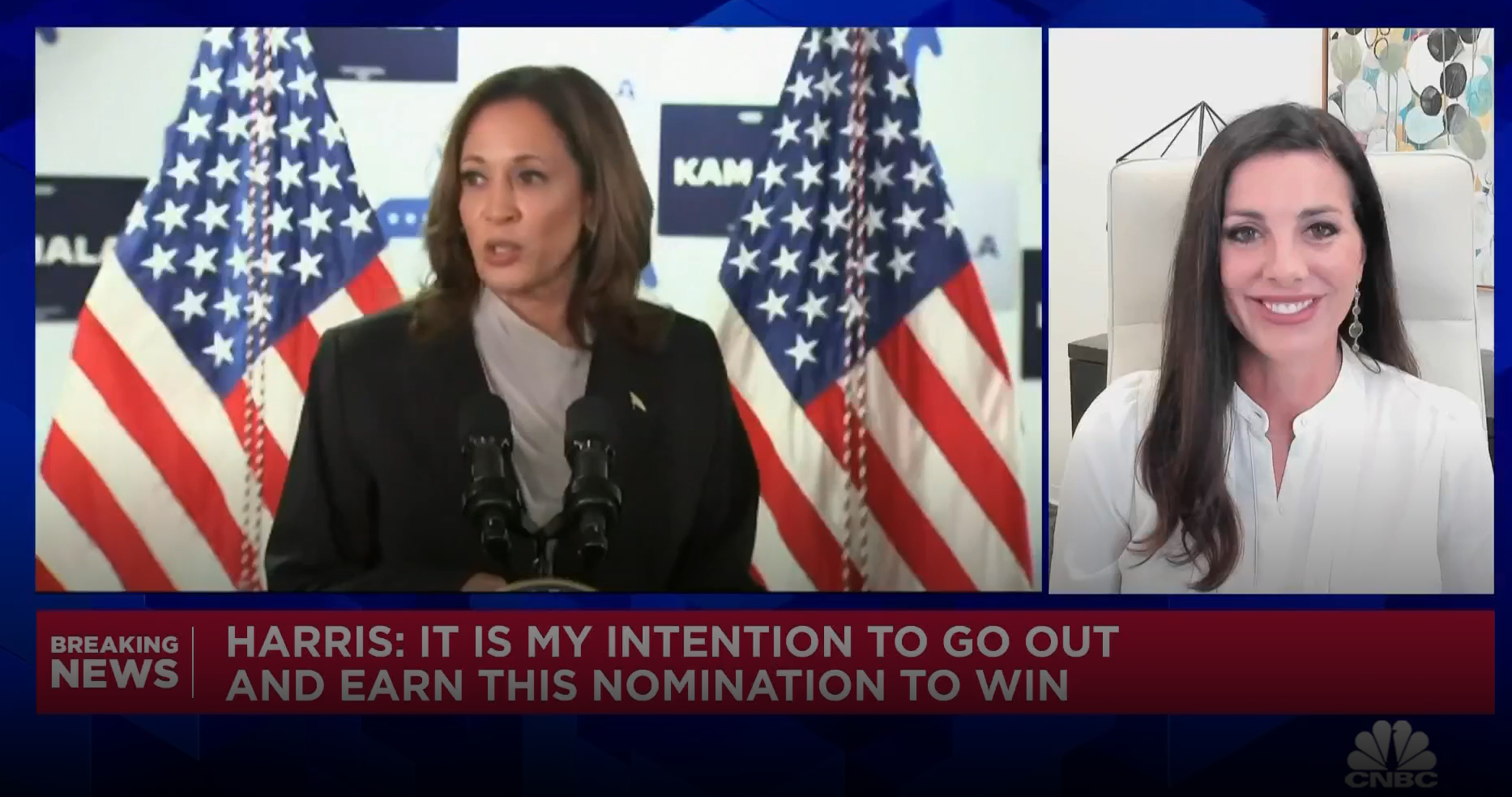

“Input costs are very important for retailers. Until the supply chain disruption is sorted and labor costs come down, we’re going to continue to see retailers struggle,” Brooke May, managing partner at Evans May Wealth in Indianapolis, said.

Rising inflation, the conflict in Ukraine, prolonged supply chain snarls, pandemic-related lockdowns in China and prospects of aggressive policy tightening by central banks have weighed on the markets recently, stoking concerns about a global economic slowdown.

Federal Reserve Chair Jerome Powell told the Wall Street Journal on Tuesday that the U.S central bank will keep “pushing” on rate hikes until it sees inflation move down in a “clear and convincing way”, not hesitating to move more aggressively if that does not happen.

Traders are pricing in 50 basis point interest rate hikes by the Fed in June and July.

“The market is very concerned about higher rates and the Fed potentially overshooting and softening the economy,” May said.

“Higher rates will obviously eat into retail spending, in addition to corporate profits, and the market is just trying to digest that.”

The S&P 500 is down 15.6% so far in 2022 and the Nasdaq has fallen more than 24%, hit by growth stocks.

Rate-sensitive Big Tech and growth companies such as Microsoft Corp, Apple Inc, Google owner-Alphabet Inc, Meta Platforms, Tesla Inc and Amazon.com fell between 1.7% and 4% after leading a sharp rebound on Wall Street in the previous session.

At 10:09 a.m. ET, the Dow Jones Industrial Average was down 488.86 points, or 1.50%, at 32,165.73, the S&P 500 was down 69.72 points, or 1.71%, at 4,019.13, and the Nasdaq Composite was down 203.08 points, or 1.69%, at 11,781.44.

Lowe’s Cos Inc fell 2.1% after reporting a bigger-than-expected drop in same-store sales, as demand eased for its home-improvement tools and building materials from pandemic highs.

However, TJX Cos Inc climbed 11% after the discount store operator forecast upbeat annual profit helped by price increases.

The CBOE volatility index, also known as Wall Street’s fear gauge, rose to 27.84 points, after falling for six straight sessions.

Declining issues outnumbered advancers for a 2.76-to-1 ratio on the NYSE and a 1.94-to-1 ratio on the Nasdaq.

The S&P index recorded one new 52-week high and 30 new lows, while the Nasdaq recorded 26 new highs and 90 new lows.