5 Tips to Make Filing Your Taxes Easier This Year, by Karen Hube in Barron’s – March 5, 2023

Feeling tax-weary? That is hardly surprising. The hassles of interacting with the Internal Revenue Service in recent years–long call wait times, refund delays, lost returns and erroneous penalty notices–are still fresh memories for millions of taxpayers. And many Americans are already encountering the same problems as they prepare and file their 2022 tax returns.

While the IRS recently hired 5,000 staffers to answer phones and process returns, and it has been making incremental changes to antiquated processing systems, the updates still leave the agency under-equipped to service the nation’s roughly 170 million individual tax returns. Even with adequate funding by Congress each year, the solution to the agency’s problems could take years to fix.

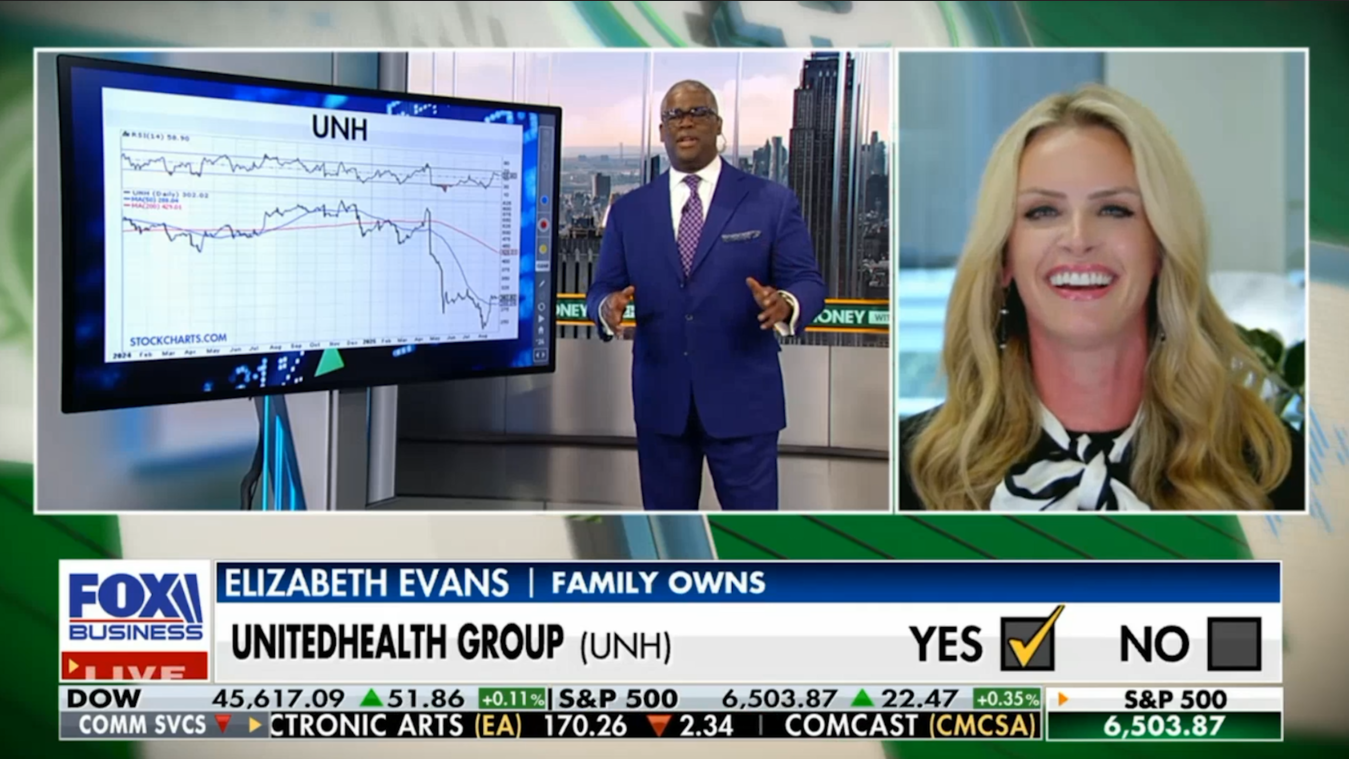

But there are steps taxpayers can take to improve their tax-filing experiences, says Brooke May, a managing partner at Evans May Wealth in Indianapolis. “If taxpayers can improve efficiencies on their end, it will help the timeliness in not only submitting a return but in having it processed and getting a refund.”

The IRS recommends taxpayers file returns electronically and opt for direct deposit to avoid delays, and tax advisors add the following lesser-known tips and tricks to further ensure a smooth process:

Always File for an Extension

Even if you plan to file your tax return before this year’s April 18 regular deadline, you may spare yourself future grief by filing for a deadline extension. Here is why: If you file your tax return and later realize you need to correct information, normally you would have to file an amended return, which will take about five months to process, according to IRS estimates.

If you have filed for an extension, there is no need to file an amended return–you simply refile your original return with changes by your extension deadline, and indicate that it should supersede your original submission, says Robbin Caruso, a partner and co-lead of Prager Matis’ national tax controversy practice.

“The IRS has added a new electronic checkbox to enable taxpayers to indicate that a superseded return is being electronically filed,” Caruso says. “Alternatively, a taxpayer may paper-file a return, marking it as a ‘superseded return’ across the top.”

Taxpayers can be granted an extension until Oct. 15 by filing a Form 4868. No reason is required. Any taxes due must still be paid by April 18 to avoid penalties.

Open an IRS Account

By establishing a personal IRS account—it takes just minutes at IRS.gov—you have easy access to all of your personal tax records. Key information such as already-filed tax returns, your adjusted gross income and digital copies of IRS notices are housed electronically in your account.

Having information at your fingertips may even spare you trying to get an IRS agent online for answers to some basic questions. An online account allows you to create and view payment plans, make payments, view five years of payment history, among other tasks.

Call the IRS During Its Quieter Hours

The IRS has a phone line dedicated for individual taxpayers with questions, but getting through has been tough. Only 13% of callers were able to get a person on the line to answer their questions last year, up from 11% in 2021, according to the Taxpayer Advocate Service.

This year, the answer rate is expected to improve but still be well below the historic average of an 80% answer rate.

While call hours are between 7 a.m. and 7 p.m. in your local time, “hold times seem to be shorter during the hours of 7 a.m. to 9 a.m.,” says Angela Anderson, an Atlanta accountant at JustAnswer.

Freshen Up on Which Forms Can Be E-Filed

Despite the IRS’s push to get taxpayers to e-file, its systems are too outdated to accept all submissions electronically.The most common of the roughly 800 tax forms and schedules can be e-filed. But taxpayers often have to attach documents to their forms– such as appraisals to support charitable donations and disclosures of so-called reportable transactions such as conservation easements –in which cases a return typically has to be mailed.

“The IRS is just beginning to develop the systems to accept those documents electronically,” says Mark Luscombe, principal federal tax analyst at Wolters Kluwer.

The IRS gradually is expanding its capabilities to accept more documents electronically. This month it announced that nine notices related to the child tax credit and the earned income tax credit can be uploaded to the IRS for the first time.

The agency also recently enabled e-filing of amended tax returns if the original return was submitted electronically. If the original was a paper return, the amended return must also be filed through the mail.

Establish a Paper Trail

Protect yourself by assuming the worst: that your mailing to the IRS will be lost, says Michael Kramarz, director of federal tax resolution at Kaufman Rossin, who had a client who was informed more than a year after filing a Form 1045 for an expedited refund that the form had to be refiled because the original couldn’t be located.

“Where was it? I’ve been to one of the service centers in Kansas City. It’s massive. It’s underground. The mail comes in day after day and you have paper stacked up everywhere,” Kramarz says. “It’s not hard to see how some returns are not processed.”

To avoid being charged late fees on lost filings or payments, keep copies of your mailings, send items by certified mail, and note on your check exactly what your payment is for, Kramarz says. “You have to maintain documentation to establish your original filing date,” he says.