We’re halfway through 2023 and it feels a lot different than 2022! Will the strong momentum we’ve seen so far continue, or will the long-expected economic slowdown finally come to fruition? We remain long-term bulls, but in the short-term, are taking a more cautious stance.

We have had an unbelievable start to the year with the Dow Jones Industrial Average (DJIA) +2.5%, S&P 500 +13% and the NASDAQ Composite +30.5% through year-to-date (as of June 29, 2023). We’ve been bullish all year, and a recovery that we expected to happen in 12 – 18 months’ time happened in six.

After 250 days of trading rangebound, the S&P 500 finally broke above 4,200, and now the market is overbought. We would not be surprised if the market retested 4,200, which would be a normally market correction allowing the market to continue its longer term rally to test the all-time high near 4,800. Markets rarely move in a linear direction- this type of testing and retesting of the lows and highs is a normal part of investing.

Taking the long-term view, we believe we are in a secular bull market. What does this mean? Secular refers to long-term trends and market cycles not clouded by short-term factors. The S&P 500 entered a secular bull market in 2013. History has shown that long-term market cycles can last 15 – 20 years, and we believe this cycle can last another 5 – 7 years.

Although secular trends do have short-term corrections, markets ultimately recover and achieve new highs.

Historically, the equity market experiences a bear market (a decline of 20% or more) every 3½ to 4 years. Interestingly, the S&P 500 has had three bear markets within four years, which is highly unusual. This has led to price adjustments in the market, giving it a longer runway for stock prices to rally.

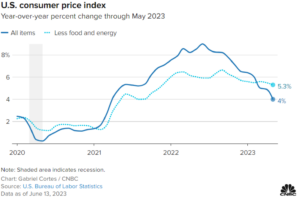

Inflation remains high; however, the May Consumer Price Index (CPI) and the Producer Price Index (PPI) came in lower than expected and inflation continues to trend lower.

The May core personal consumption expenditures (PCE) price index, one of the Fed’s most closely watched data points, rose less than expected. Core PCE increased 4.6% from a year ago, below the 4.7% expected by economists. Including the volatile food and energy components, inflation was considerably softer – up just 0.1% on the month, and 3.8% from a year ago. Those were down respectively from the 0.4% and 4.3% increases reported for April.

After 10 consecutive rate hikes, the Federal Reserve decided to pause and not raise rates during their June meeting. While the pause was mostly expected, many were surprised by the Fed’s caveat that they are likely not done raising rates. The Fed says they remain data dependent from meeting to meeting. Most of the central bank’s policymakers expect they will need to raise interest rates two more times by year-end but did not give an indication as to when those rate hikes would The market is currently pricing in a 0.25% rate hike during the July Fed meeting.

Looking ahead at earnings forecasts, we’re seeing some positive momentum. For Q3 2023, the estimated earnings growth rate is 0.8%, and for Q4 2023, the estimated earnings growth rate is 8.2%. If we see the estimated 8.2% growth, that will mark the highest year-over-year earnings growth rate reported by the S&P 500 since Q1 2022 (9.4%).

Equity markets have a way of doing the opposite of what most expect. Investor sentiment was very pessimistic going into 2023 yet markets rallied during the first half of 2023. Investor sentiment is now above average, the valuation (forward P/E) on the S&P 500 is above the 10-year average despite interest rates continue to increase and corporate earnings growth slowing. These are typical indicators of the “optimism phase” of a market cycle. It is counterintuitive, but it’s part of the normal cycle. During the optimism phase, real price return for the S&P 500 is historically positive, returning 29% over a 22-month period.

As mentioned above, we believe the market will test its all-time highs near 4,800, with bouts of volatility along the way. Now is the time to stay balanced, take profits where appropriate, proceed cautiously, and do not chase the FOMO (fear of missing out) trade.

We continue to focus on maintaining balanced and high-quality portfolios to take advantage of future rallies but remain resilient during volatility.

We want to wish you and your family a wonderful summer ahead!

Read the written commentary here.