We hope this message finds you and your family well. 2022 is certainly off to a bumpy start with daily volatility at the highest levels since 2020, as measured by the CBOE Volatility Index (VIX). As of today, all three major U.S. stock market indices (the Dow Jones Industrial Average, the S&P 500, and the Nasdaq) are in “correction” territory, with the DJIA -10.63% year-to-date (YTD), S&P 500 -12.49% YTD, and the Nasdaq -17.32% YTD.1 The increased volatility can be attributed to inflation, interest rate hikes, and geopolitical tensions. We will cover each of these topics, as well as an update on corporate earnings, in this market update.

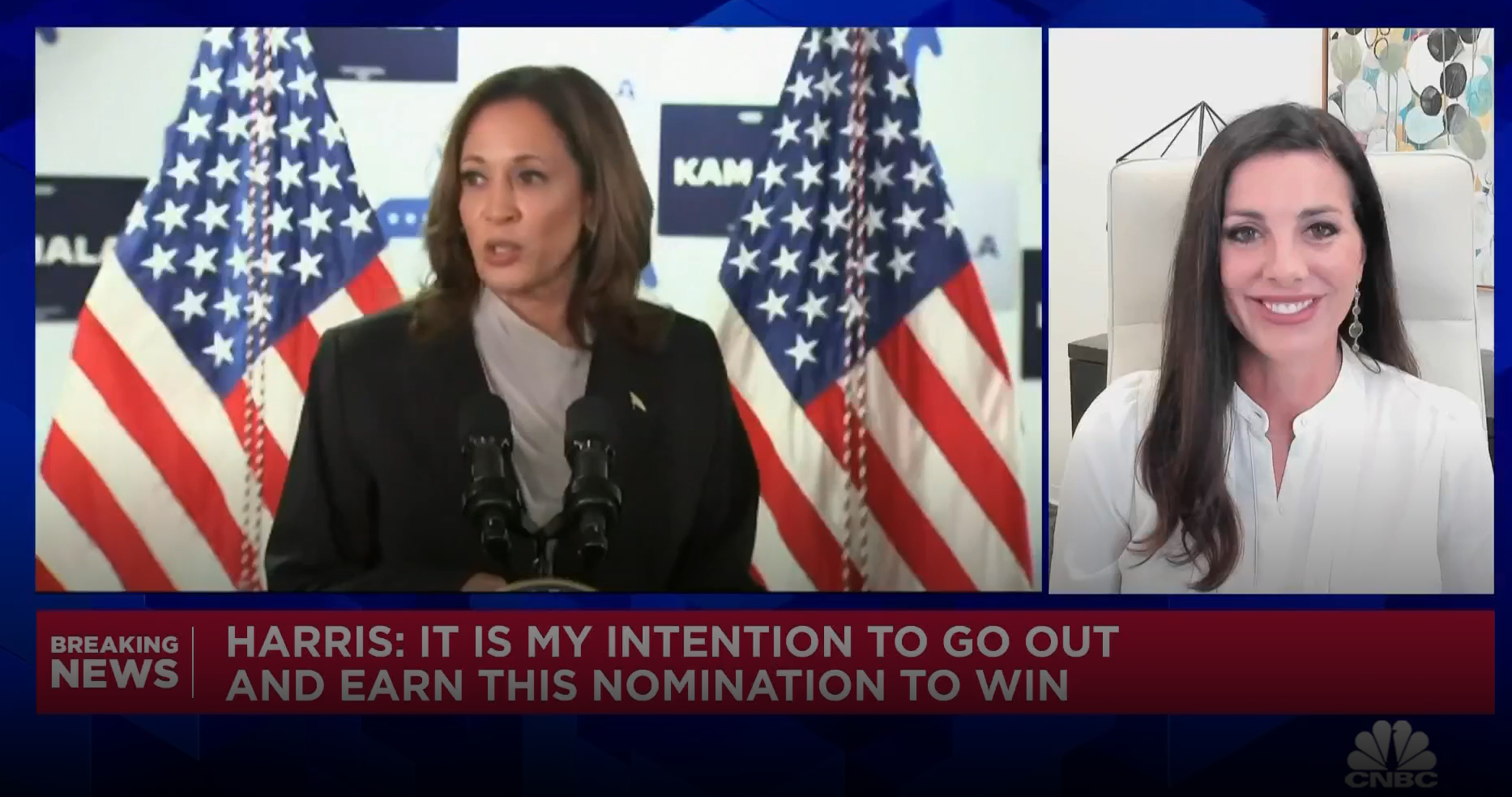

Russia/Ukraine Conflict

We woke up this morning to news that Russia had invaded Ukraine. Over the last few weeks, the Russia/Ukraine conflict has created additional volatility in the market, and today is certainly no exception. While history is not a guarantee of future outcomes, we believe it is instructive to look back at similar periods where geopolitical conflict resulted in market selloffs. History indicates that we may have less to worry about than feared. Analysis performed by Vanguard illustrates that the average total return for the market 6 months and 12 months after the geopolitical event was +5% and 9%, respectively.

In other words, while the humanitarian impact of such conflicts can be dire, history shows that there has not been a lasting impact on the stock market.

Inflation

Inflation is also top of mind for our team. It’s no secret that prices have been steadily increasing, and we know you have likely felt the price pressure at the gas station, grocery store, and beyond. Inflation hit a whopping 40- year high in January at a +7.5% annual rate.2 We attribute high inflation to increased money supply, government stimulus, and supply constraints in the goods and labor market, all of which have created a pressure cooker for inflation.

The impact of the Russia/Ukraine conflict on commodity price inflation, particularly as it relates oil and natural gas prices, creates additional complexity in the Federal Reserve’s fight against inflation. As of today, intraday oil prices exceed $100/barrel, price levels we have not seen since 2014. This creates an additional challenge for the Federal Reserve as it tries to cool inflation. We expect the impact to be greater on Europe given its reliance on Russia for oil and natural gas. Nearly one-third of Europe’s natural gas and one-fourth of Europe’s crude oil is supplied by Russia.

As many of you know, we strategically underweighted our international equity allocation, which should help weather the uncertainty and volatility stemming from the Russia/Ukraine conflict. We are keenly focused on the Biden Administration’s strategy for increasing oil supply (potentially through negotiations with Saudi Arabia) to reduce oil prices over the short-term.

Federal Reserve and Interest Rates

The Federal Open Market Committee (FOMC) meets again on March 15, when we will learn more about its plan for increasing interest rates. We expect the Federal Reserve to be more aggressive in raising interest rates to cool inflation. Major investments banks are calling for between 5 and 7 interest rate hikes this year, with many expecting the first interest rate increase to be announced at the March FOMC meeting.3 The magnitude and frequency of interest rate hikes will be primarily dictated by inflation data released on March 10 before the FOMC meeting. The FOMC has also hinted at quantitative tightening, or shrinking its balance sheet, to rein in the abundant money supply. We expect this to occur later this year.

Corporate Earnings

While consumer sentiment is very low right now, mostly due to inflation, data on consumer behavior remains strong with Retail Sales +13% year-over-year.4 Corporate earnings continue to be strong, with Q4 earnings growth at almost +31% vs an estimated +21%.5 Earnings guidance has been weaker this quarter, in part due to uncertainties around inflation and supply constraints. We continue to anticipate large discrepancies in performance between the winners and losers in the stock market and expect speculative areas of the market to continue to underperform.

Despite the volatility year-to-date, the consensus 12- month target price for the S&P 500 is 5312.706 , which implies a 27% increase7 over the next 12 months. This target price is higher than the 12-month target price for the S&P 500 at the end of 2021.

Clients that have worked with us for many years will tell you that our investment approach and philosophy does not waver in times of volatility. We develop investment strategies and construct portfolios that are balanced and focused on high-quality segments of the market. We seek to invest in companies with strong balance sheets, proven products/services, and a track record of earnings. This philosophy helps our clients’ portfolios weather periods of volatility.

We are closely monitoring your investment portfolio, actively rebalancing as the market moves, and taking advantage of opportunities, as warranted. If you have any questions or would like to discuss your portfolio, please contact our office.

– Evans May Wealth

1 Based on intraday prices

2 U.S. Bureau of Labor Statistics, February 10, 2022

3 Reuters, February 18, 2022

4 National Retail Federation, February 16, 2022

5 FactSet, February 18, 2022

6 FactSet, February 18, 2022

7 Based on intraday pricing as of February 24, 2022