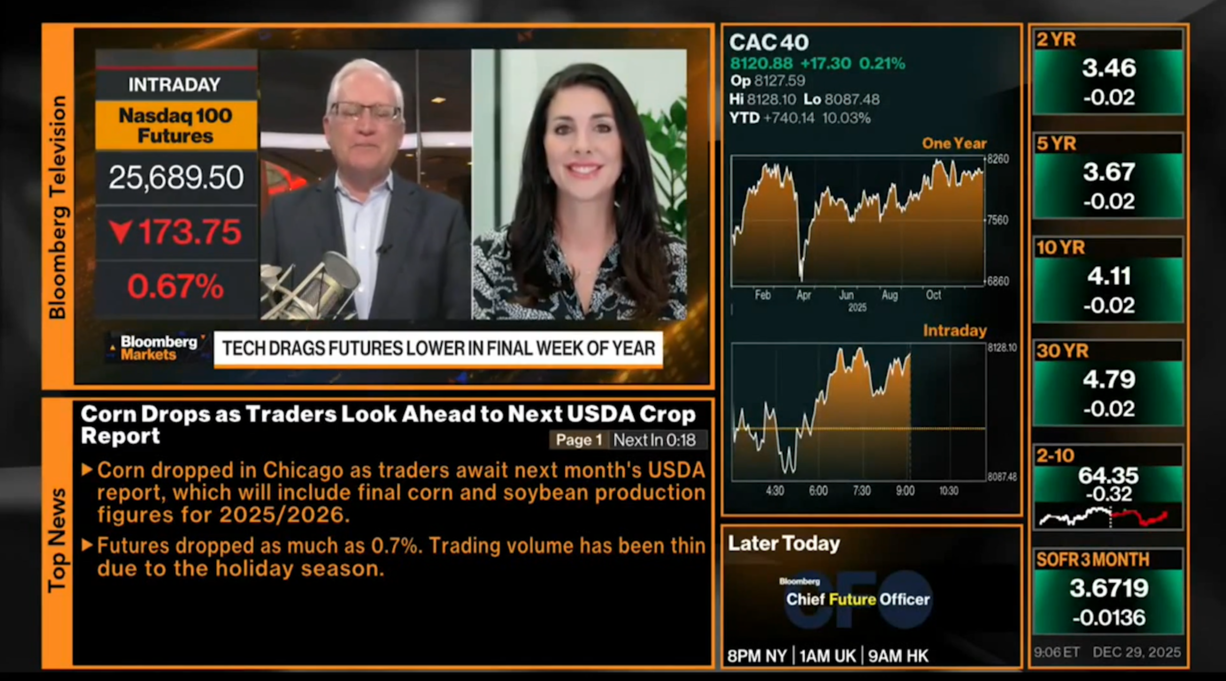

At Evans May Wealth, we believe in building wealth through a balanced portfolio tailored to each individual’s goals and risk tolerance. Our investment approach combines proprietary and third-party strategies, focusing on financially sound companies with competitive advantages and strong balance sheets. This disciplined approach to diversification and high-quality investments provides the most value for our clients.

Evans May Wealth is a well-established wealth management team with decades of experience specializing in serving families, executives, and business owners.

With in-house CERTIFIED FINANCIAL PLANNERS™, a CERTIFIED EXIT PLANNING ADVISOR™, a Registered Social Security Analyst, (RSSA®) and a team of twelve advisors and staff to support your everyday needs, we deliver a family office experience to our clients.